Unlocking the Future: Predicting Stock Prices with LSTM

Background

An investment broking firm providing stock price prediction services using traditional methods wants to eliminate the struggle to capture complexities of stock price movements, leading to inaccurate predictions and suboptimal investment decisions.

Challenge

The firm aims to enhance stock price forecasting accuracy for its customers and aid decision-making processes in financial markets.

Solution

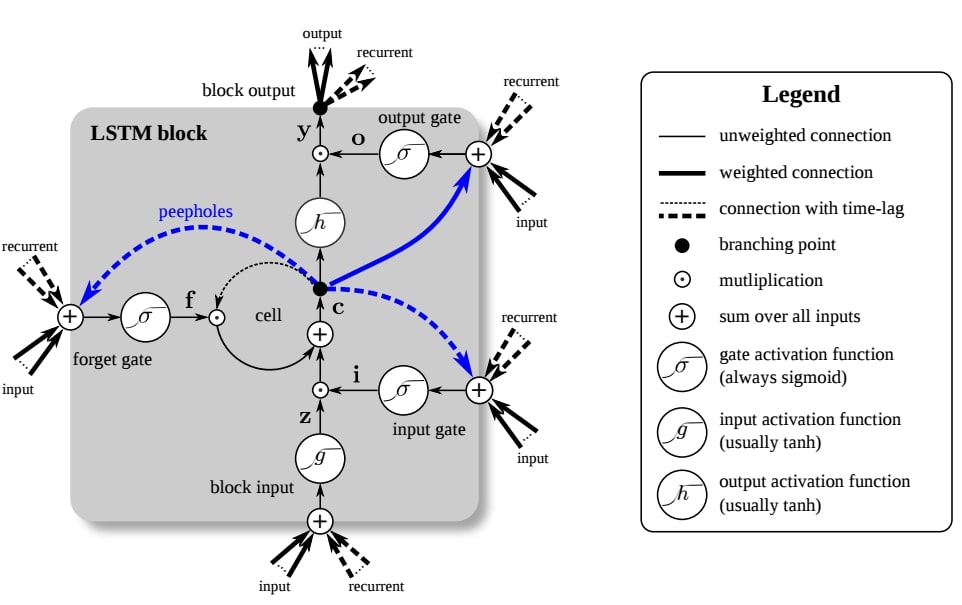

Our team helped to overcome this by leveraging LSTM models.

Execution involves data collection, preprocessing, model training, evaluation, and deployment. Data are collected from financial markets and processed using Python and relevant libraries. LSTM models are trained on historical data with attention to hyperparameter tuning and model validation. Risks such as overfitting and data quality issues are mitigated through robust validation procedures. Successful execution relies on effective planning, rigorous analysis, and continuous monitoring of model performance.

Result

LSTM networks, designed to address the vanishing gradient problem, are utilized for stock price forecasting. By leveraging historical data and technical indicators, LSTM models learn complex patterns, offering valuable insights for investors and analysts.

Impact

This resulted in significant financial impact of LSTM-based stock price prediction. Accurate forecasts empowered investors to make informed decisions, optimize portfolio management, and potentially maximize returns on investment. Adoption of LSTM models enhanced market efficiency and reduce investment risks.